Gold Mining Giants Face Rising Costs and Market Uncertainty

The gold mining industry is navigating a complex landscape, benefiting from gold prices supported by ongoing geopolitical uncertainties and inflationary pressures, while simultaneously facing significant operational headwinds. The sector is grappling with high production costs, including rising expenses for fuel, electricity, and labor. This situation is putting considerable pressure on the profit margins of mining companies.

Cost Pressures and the Industry's Response

The surge in energy and fuel prices, which are essential inputs for mining operations, remains one of the industry's biggest challenges. Additionally, labor shortages and supply chain disruptions are further driving up costs. In response to this challenging environment, leading companies such as Newmont (NEM), Barrick Gold (GOLD), and Agnico Eagle Mines (AEM) are taking steps to enhance operational efficiency. Investments in automation, digitalization, and innovative mining technologies are central to their efforts to control costs and boost productivity.

Future Outlook and Price Dynamics

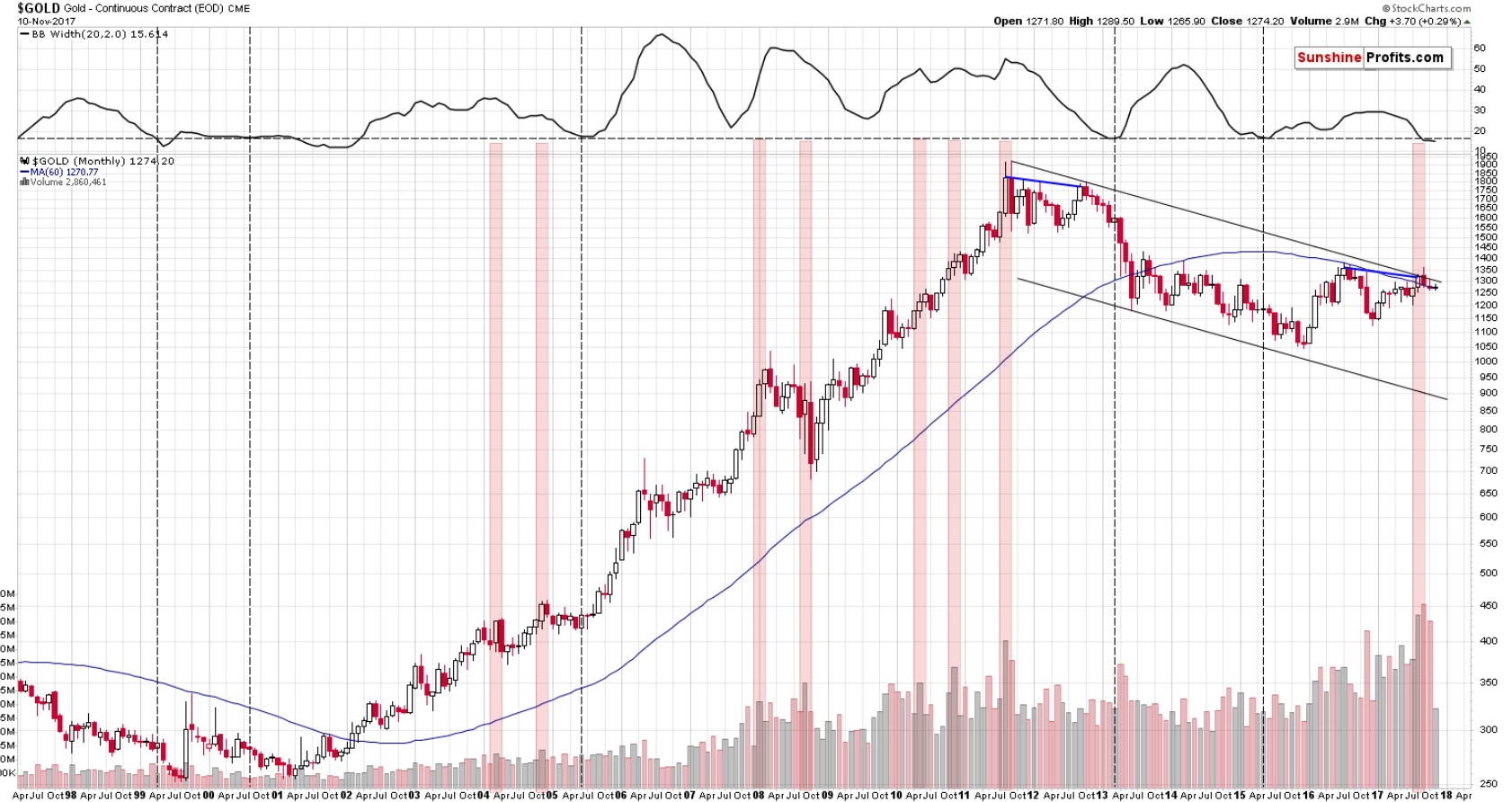

Gold is traditionally viewed as a safe-haven asset during times of economic uncertainty. Current global tensions and ambiguity surrounding central bank monetary policies continue to sustain demand for gold. Analysts predict that the U.S. Federal Reserve's future stance on interest rates will be a key determinant for gold prices. A loosening of interest rates typically weakens the dollar, which in turn pushes gold prices higher. Meanwhile, mining companies are also adapting to new trends like sustainability and the green energy transition, which could create new opportunities for the sector in the long run.

Conclusion

The gold mining sector is striving to strike a delicate balance between the opportunities presented by high gold prices and the challenges posed by rising operational costs. Increased efficiency and technological innovation are critical for companies to remain resilient during this difficult period. In this context, one of the companies mentioned in the outlook, Kinross Gold (KGC), has significant mining operations in Turkey. The company's operations in Turkey serve as a key example of the local implications of global cost pressures and efficiency strategies. The global dynamics in the sector have the potential to directly impact mining activities and the investment climate in Turkey.