Global gold search expenditures hard decrease in the opportunity to turn into an opportunity for Türkiye

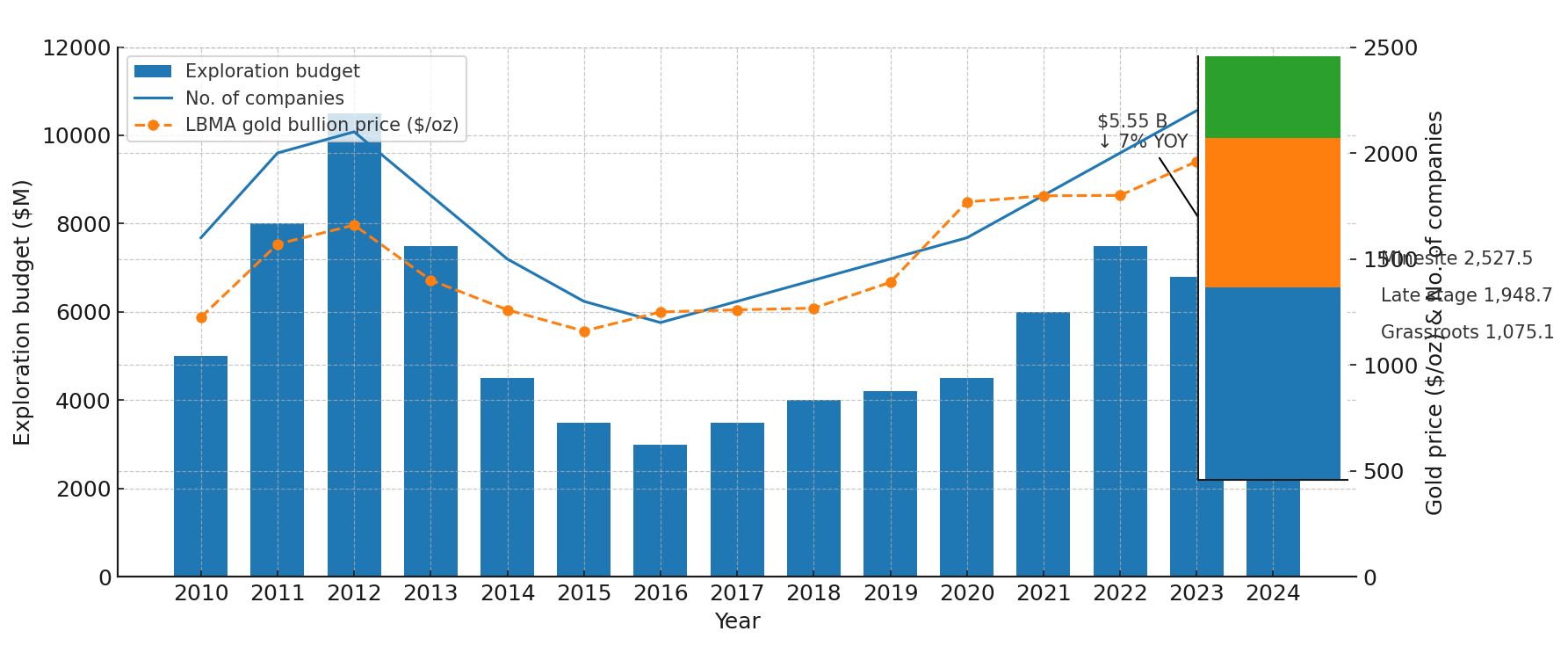

In the global gold mining sector, despite high gold prices, there has been a noticeable decline in exploration spending. According to S&P Global data, gold exploration budgets fell by 15% in 2023 and by 7% in 2024. This decline has particularly impacted grassroots projects. While in the 1990s, grassroots exploration accounted for 50% of the budget, today it has dropped to 19%.

According to the CES 2024 report, the total exploration budget for 2024 stood at USD 5.55 billion, marking the lowest level in the past decade. The number of companies exploring for gold also dropped by 8% in the same period, down to 1,235. This situation makes the discovery of new large deposits more difficult. Between 2023–2024, no major new discoveries were made; in the last four years, only six significant discoveries containing 27 million ounces of gold took place.

An Opportunity Window for Turkey

Over the past 20 years, Turkey has made significant strides in gold production, becoming one of Europe’s largest producers. Since 2001, 15 mines have become operational, production reached 38 tons in 2020, and the target is 100 tons within five years. The contraction in global exploration spending may further enhance Turkey’s geological potential and investment appeal. Government incentives, along with low licensing and rental costs, create advantages for local investors.

Investment and Rental Analyses in Turkish Lira

- An exploration investment of USD 1 million corresponds to approximately 45 million TL at the current exchange rate of 45 TL/USD. For TL-based domestic firms, this means a cost advantage in foreign currency terms.

- Gold certificates traded on Borsa Istanbul in April 2025 were priced at a 21% premium compared to physical gold. This allows TL-based investors to achieve high short-term returns.

- Gold exploration projects in Turkey could generate returns within 3–4 years in strong reserves. In the inflationary TL environment, local players who can control their costs may shorten this payback period.

Risks and Sustainability

For Turkey to capitalize on this opportunity, it must maintain environmental and social responsibility standards. The 2024 landslide at the Çöpler Gold Mine in Erzincan highlighted once again how critical safety and environmental management are for the sector.

Conclusion

The sharp decline in global gold exploration spending creates a strategic advantage for Turkey in gold production and investment attraction. With TL-based cost advantages, government incentives, and geological potential combined, Turkey is emerging as one of the strongest candidates to fill this global gap.